Problem 231: A traditional individual retirement account (IRA) is a special type of retirement account in which the money you invest is exempt from income taxes until you withdraw it. If you deposit $100 each month into an IRA earning 6% interest, how much will you have in the account after 20 years?

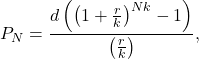

Solution: This type of accounts are called savings annuity. One can calculate the amount present in the annuity account with the following formula:

(1)

where ![]() is the balance in the account after N years,

is the balance in the account after N years, ![]() is the regular deposit (the amount you deposit each year, each month, etc.),

is the regular deposit (the amount you deposit each year, each month, etc.), ![]() is the annual interest rate in decimal form,

is the annual interest rate in decimal form, ![]() is the number of compounding periods in one year.

is the number of compounding periods in one year.

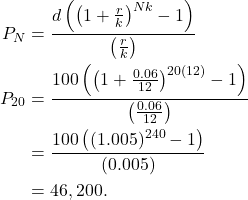

For our problem, we are looking for ![]() , and we are given

, and we are given ![]() and

and ![]() .

.

(2)

Thus, in 20 years you will have $46,200.

Leave a Reply